2026 Climate Reckoning: Why Economic Survival Now Depends on Resilience

For decades, policymakers framed climate action as a trade-off between environmental protection and economic growth.

In 2026, that argument has effectively collapsed. Across financial capitals—from London’s trading floors to Europe’s industrial corridors—the consensus is shifting: climate resilience is no longer a “green” add-on. It is the baseline condition for fiscal solvency and long-term competitiveness.

While global headlines remain dominated by geopolitical brinkmanship and shifting trade alliances, a quieter but more consequential transformation is unfolding inside central banks, finance ministries, and corporate boardrooms.

Environmental shocks are no longer dismissed as unforeseeable “acts of God.” They are being priced as recurring, high-frequency events that directly influence sovereign creditworthiness, corporate valuations, and insurance markets.

According to the latest assessments from the World Meteorological Organization, the opening weeks of 2026 have already delivered record-breaking heat in parts of the Southern Hemisphere and renewed instability in the polar vortex, placing strain on European energy systems. These are not isolated weather anomalies—they are systemic economic disruptors reshaping risk models worldwide.

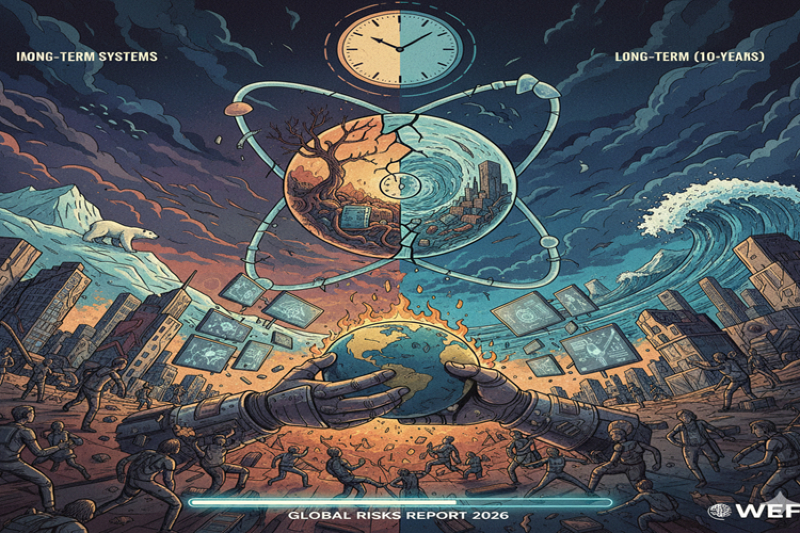

At the same time, the World Economic Forum’s Global Risks Report 2026 underscores a pivotal shift: climate risk is no longer a distant environmental concern. It has become the operating system of the global economy.

Navigating the Age of Permacrisis: Climate Resilience as the Global Anchor

As 2026 unfolds, the boundary between geopolitics and environmental policy has blurred. Strategic competition, energy security, trade access, and military stability now operate within a climate-constrained reality.

European institutions are among those recalibrating fastest. The European Investment Bank has redirected billions toward clean heating, transport electrification, and adaptation infrastructure—not as symbolic gestures, but as safeguards for long-term economic functionality.

This strategic recalibration reflects a broader shift from abstract environmentalism to what many policymakers now describe as “Climate Sovereignty”: the ability of a state to shield its infrastructure, food systems, labor productivity, and energy grids from intensifying physical risks.

The Move from Anticipation to Experience

The global economy has entered what analysts call the “age of experience.” Climate disasters are no longer theoretical projections—they are recurring line items.

With extreme weather losses consistently exceeding $100 billion annually, climate exposure is now embedded in balance sheets.

Insurers are retreating from high-risk regions. Governments are absorbing uninsured losses. Corporations are reassessing supply chains.

In Europe alone, cumulative losses from climate extremes have surpassed $500 billion in recent decades, with a significant portion uninsured. This has revealed a structural blind spot in traditional GDP-based economic modeling.

Organizations such as Carbon Tracker and researchers at the University of Exeter warn that beyond 2°C of warming, economic damage becomes non-linear—small temperature increases can trigger disproportionately large financial shocks, workforce disruption, and infrastructure degradation.

The Intersection of Markets and Conflict

Climate instability is also reshaping global policy instruments and security calculations.

Under the European Union Emissions Trading System, carbon permit prices have surged past €100 in 2026, reinforcing incentives for decarbonization. Yet rising prices have also attracted speculative capital, raising concerns about excessive financialization.

If carbon markets become detached from industrial fundamentals, volatility could undermine business confidence and slow the energy transition they are meant to accelerate.

Beyond markets, environmental stress increasingly intersects with security dynamics. The UN Environment Programme estimates that around 40% of intrastate conflicts in recent decades have been exacerbated by resource pressures.

In fragile regions already navigating military tensions and political uncertainty, climate-driven scarcity acts as a force multiplier—deepening instability and migration pressures.

The message from 2026 is unmistakable: environmental risks are not competing priorities alongside geopolitical threats. They are the structural conditions shaping them.

The European Context: From Risk to Resilience

Europe is at the forefront of embedding climate risk into financial governance.

Regulators increasingly classify climate exposure as a core threat to financial stability rather than a niche sustainability issue. Stress testing now includes flood risk, heat exposure, and supply chain disruption.

Financial predictability—once centered solely on interest rates and fiscal deficits—now incorporates emissions trajectories and adaptation capacity.

The EU’s carbon pricing architecture is designed to send long-term decarbonization signals. The challenge ahead lies in maintaining market integrity while preventing speculative distortions that could weaken industrial competitiveness.

Simultaneously, mechanisms such as the Carbon Border Adjustment Mechanism (CBAM) are reshaping trade dynamics, linking climate performance to market access. For exporting nations and multinational corporations, climate metrics are becoming trade credentials.

Climate vs. Nature: The Strategic Distinction

Although climate and biodiversity are deeply interconnected, policymakers increasingly emphasize climate risk because it translates directly into economic language:

Asset Protection: Quantifying heat, flood, and wildfire exposure for infrastructure portfolios.

Market Access: Aligning production standards with carbon border requirements.

Capital Allocation: Integrating forward-looking climate models and AI-driven forecasting into investment decisions.

This reframing allows leaders to move beyond moral appeals toward measurable economic safeguards.

The Actionable Outlook for 2026

Data from the World Meteorological Organization confirms that the human and financial toll of climate disasters continues to escalate. In response, governments and corporations are adopting a precautionary approach grounded in three pillars:

Investing in Adaptation:

The global market for adaptation solutions—ranging from resilient infrastructure to climate analytics—has surpassed $1 trillion. Resilience is emerging as a growth sector rather than a regulatory burden.

Refining Economic Models:

Think tanks and financial analysts are shifting away from narrow GDP scenarios toward climate-aware stress testing that captures tail risks beyond the 2°C threshold.

Embedding Climate Intelligence:

From water efficiency to carbon intensity, sustainability KPIs are being integrated directly into capital allocation frameworks. When financing costs reflect exposure to climate risk, structural transformation accelerates.

The Intelligence Gap

Despite mounting evidence, a perception gap persists. Short-term political crises dominate media cycles, while climate risk quietly compounds in the background.

The WEF’s 2026 findings reveal that environmental threats have dipped in short-term perception rankings—not because they are diminishing, but because they have become normalized. This normalization is dangerous. When risk becomes routine, urgency fades even as losses mount.

The Mandate for Global Leaders

To bridge the divide between immediate “radar” crises and long-term strategic mapping, leaders must move from narrative commitments to operational execution:

Operationalize Sustainability: Tie capital costs to measurable resilience metrics.

Guard the Markets: Ensure carbon and nature markets function as transition tools, not speculative playgrounds.

Deploy Advanced Forecasting: Use forward-looking climate models to stress-test infrastructure before disaster strikes.

The cost of delay is quantifiable. For every dollar currently invested in nature protection, an estimated thirty dollars continue to flow into environmentally destructive activities. Until that imbalance shifts, financial exposure will intensify.

Conclusion: No More Trade-Offs

The defining insight of 2026 is clear: there is no stable economy inside an unstable ecosystem. Climate risk is not a competing policy priority—it is the structural backdrop against which all other economic and geopolitical strategies unfold.

Resilience is no longer an environmental slogan. It is a competitive advantage. The nations and corporations that embed climate intelligence into every strategic decision will secure continuity in an increasingly volatile century. Those that fail to adapt will discover that ignoring nature is no longer merely negligent—it is fiscally unsustainable.

▶ Read more:

https://theenvironnews.blogspot.com/2026/02/the-2026-climate-pivot-why-fiscal.html

https://theimpartial24.blogspot.com/2026/02/the-2026-climate-pivot-why-fiscal.html