Mobile Banking Curbs Trigger Widespread Hardship for Poor and Middle Class

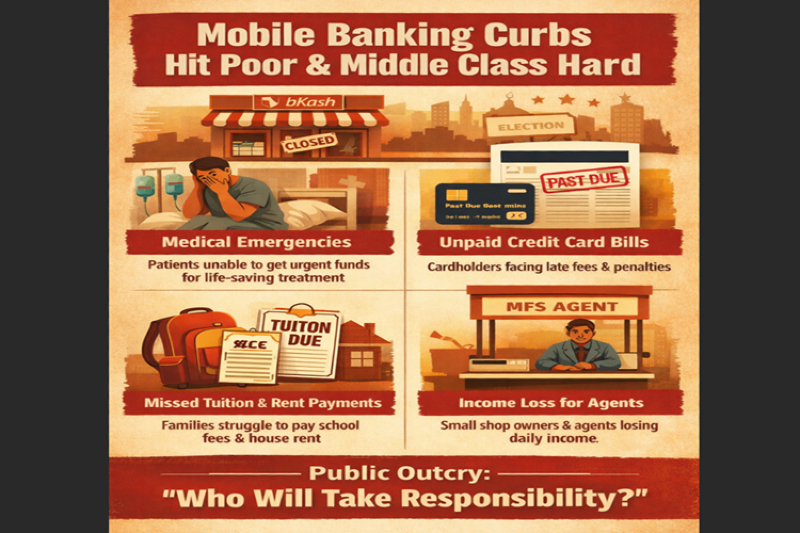

Dhaka, February 9, 2026 — The Bangladesh Bank’s decision to impose nationwide restrictions on mobile financial services (MFS) ahead of the 13th national parliamentary election has triggered severe financial hardship for millions of people, disproportionately affecting the poor and middle-income groups who rely on instant digital transactions for survival, healthcare, education, and daily living.

An on-the-spot assessment across Dhaka and several district towns found that most mobile banking agent outlets remained closed on Monday, with the suspension set to continue until midnight on February 12. The sudden disruption has effectively paralysed a critical financial lifeline for both urban and rural households.

Livelihoods Frozen Overnight

From Dhaka to remote villages, thousands of people earn their livelihoods directly through mobile banking services. Agents, small traders, daily wage earners, and informal workers depend on uninterrupted MFS operations for daily cash flow. The abrupt restrictions have left many without income for days, pushing already vulnerable families deeper into financial distress.

Several mobile banking agents reported a complete shutdown of operations, saying they had no alternative means to assist customers seeking emergency transactions.

Medical Emergencies Turn into Financial Nightmares

The impact has been particularly devastating for families dealing with medical emergencies. For patients suffering from critical illnesses such as cancer, kidney failure, and heart disease, timely access to funds can mean the difference between life and death.

Sajib Ahmed, a college student from Kushtia, shared his ordeal after admitting his father to a cancer hospital in Dhaka.

“I came to Dhaka with a limited amount of money just to start treatment. My mother and sisters sold a small piece of land and arranged Tk 4 lakh, but they cannot send it to me because mobile banking is restricted. I am in great danger,” he said.

Families say that even an hour’s delay in arranging funds can prove fatal, making a four-day restriction unacceptable in emergency healthcare situations.

Urban Families Struggle with Rent and Education Costs

Thousands of families living in Dhaka and other cities depend on mobile banking transfers from relatives to pay house rent, school and college tuition fees, and basic household expenses. With payment deadlines approaching, many guardians now face the risk of eviction notices, late fees, and academic disruption for their children.

Parents expressed concern that schools and coaching centres rarely make allowances for payment delays, regardless of the circumstances.

Credit Card Users Face Penalties Beyond Their Control

The restrictions have also trapped salaried individuals who rely on mobile banking to pay credit card bills on time. Many fear late penalties, additional interest charges, and damage to their credit records.

Md Haider Ali, a service holder in Dhaka, said he had deposited money into his mobile wallet in advance to settle his credit card bill.

“I was waiting for the last date to pay my bill. Suddenly, the restriction came into effect. I cannot transfer or cash out the money. Now I will be fined for no fault of mine,” he said.

‘Who Will Take Responsibility?’

Public frustration is growing over what many describe as a blanket decision that fails to distinguish between political risk management and civilian necessity.

Abu Bakar, a teacher from Mirpur-1 in Dhaka, voiced a question echoed by many affected citizens:

“We have no involvement in politics. We live on hard-earned money. Why should we pay penalties and suffer losses because of someone else’s decision? Who will take responsibility for this?”

Background: Election-Time Financial Restrictions

On February 8, Bangladesh Bank announced restrictions on mobile financial services and internet banking to prevent the misuse of funds during the 13th national parliamentary election.

Under the directive:

MFS users can send a maximum of Tk 1,000 per transaction, with a daily cap of Tk 10,000.

Person-to-person transfers via internet banking and banking apps have been temporarily suspended.

Merchant payments and utility bill payments remain operational.

MFS providers have been instructed to closely monitor transactions and report suspicious activity to law enforcement.

Emergency response teams have been formed to coordinate with the Election Commission and police.

Public Interest vs Administrative Control

While authorities argue the measures are necessary to ensure election integrity, critics say the decision has overlooked the everyday realities of millions who depend on digital financial services for basic survival.

Economists and rights advocates warn that prolonged or repeated restrictions of this nature risk undermining public trust in the digital financial ecosystem—one of Bangladesh’s most significant achievements in financial inclusion.

No Official Response from Bangladesh Bank

Attempts to obtain comments from the Bangladesh Bank governor and other senior officials were unsuccessful, as the phone number (880255665001) listed on the central bank’s official website was found to be inaccessible and returned a recorded response stating it was a “wrong number.”

When contacted, a senior official attached to the Finance Advisor of the interim government said, “We do not deal with this issue. Please contact the Bangladesh Bank in this regard.”

As the restriction period continues, calls are growing for urgent humanitarian exemptions, clearer communication, and accountability mechanisms to shield ordinary citizens from unintended yet devastating consequences of administrative decisions.